IncisiveFX

IncisiveFX launches in a world in which the post-war hegemony is breaking down and a new 21st-century order is being established. Geopolitical shifts, new alliances, tariffs, the rowing back of free trade and huge technological change herald this new epoch.

This will materially impact foreign exchange direction and value.

Our aim is to help you navigate this change.

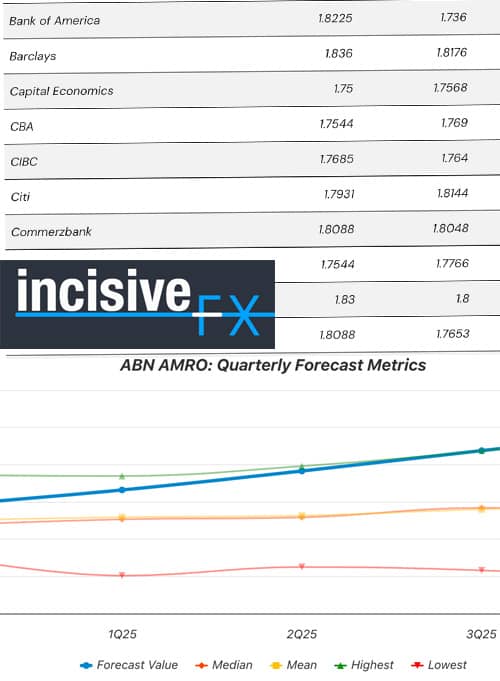

- Rolling forecast updates

- Median, mean, highest and lowest forecast targets

- FX strategy

Effective currency management

40+

Investment banks and instituions surveyed and growing

25+

Currency pairs forecasted

100+

Finance teams signed up pre-launch

A Comprehensive Forecast and FX Risk Management Suite

IncisiveFX is in beta stage, which means we are in building mode. This is why we don't charge for the service and instead share our data and invite businesses to give feedback and tell us what they want.

This is why we only accept verifiable business registrations. We are working to deliver:

- Options market screeners

- FX risk radar

- Market skews and positioning

- Bespoke forecast models

Welcome to IncisiveFX 'Beta'

launch Big things are coming

IncisiveFX is in beta stage, which means we are in building mode. This is why we don't charge for the service and instead share our data and invite businesses to give feedback and tell us what they want. This is why we only accept verifiable business registrations.

value Real Value

You would require a license with Reuters (Refinitiv) or Bloomberg to normally access our bespoke exchange rate forecast data. The starting cost for such a package is £1200 / $1500 per month.

research Over 40 Investment Banks

Over 40 investment banks are surveyed at regular intervals. These include Goldman Sachs, Morgan Stanley, Barclays and HSBC. But we also survey leading independent research institutions in order to broaden the dataset with non-institutional thinking.

strategypoint forecasts vs. strategy

Users can view research and strategy snapshots from major institutions to contextualise the data and current market developments. Importantly, strategy and the house-view might differ, with strategy providing important near-term signal

incomingRisk Radar

Our roadmap will bring exciting additions to the suite, including a risk radar that allows our users to analyse skew in the market and looming high-volatility events.